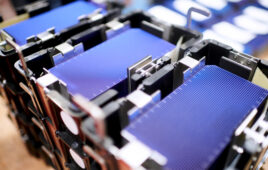

A new ranking of the top polysilicon manufacturers from German research firm Bernreuter Research shows that four of the world’s five largest producers are based in China. And although Germany-based Wacker Chemie, which also has a polysilicon plant in Tennessee, ranks second on the list for 2020, the company’s president has said there are no plans to increase production of solar-grade polysilicon. Bernreuter Research therefore predicts that the Top 4 polysilicon manufacturers will all be from China by 2022.

![]() Why this matters: There is continued concern that forced labor is being used in China’s Xinjiang province, where already the vast majority of polysilicon — the absolute foundational building block of solar panels — is produced. The area is also prone to use coal-fired power plants for electricity. The global solar industry will be hard-pressed to avoid this relation.

Why this matters: There is continued concern that forced labor is being used in China’s Xinjiang province, where already the vast majority of polysilicon — the absolute foundational building block of solar panels — is produced. The area is also prone to use coal-fired power plants for electricity. The global solar industry will be hard-pressed to avoid this relation.

The top 10 polysilicon manufacturers for 2020 include:

- Tongwei (China)

- Wacker (Germany/United States)

- Daqo New Energy (China)

- GCL-Poly (China)

- Xinte Energy (China)

- Xingjiang East Hope New Energy (China)

- OCI (South Korea/Malaysia)

- Asia Silicon (China)

- Hemlock (United States)

- Inner Mongolia Dongli Photovoltaic Electronics (China)

Seventh place OCI slid down the list after shutting down its solar-grade polysilicon operations in South Korea last year. Wacker, which had been No. 1 overall before dropping to second this year, is still the world’s largest manufacturer of electronic-grade polysilicon for the semiconductor industry. Compared to its rapidly expanding Chinese competitors, however, Wacker has no intention to increase its solar-grade capacity beyond continuous debottlenecking. “We are certainly not interested in building incredible, new capacities,” said CEO Rudolf Staudigl on a conference call about his company’s first-quarter results on April 30.

Consequently, Wacker will be overtaken by three more Chinese manufacturers and fall back to No. 5 in 2022, predicts Bernreuter Research.

“The rise of China-based players in our ranking is exemplary for the increasing dominance of the Chinese polysilicon industry,” said Johannes Bernreuter, head of Bernreuter Research and author of the Polysilicon Market Outlook 2024. “China’s share in the global solar-grade polysilicon output will approach 90% in the coming years.”

The three likely companies to surpass Wacker for the top four spots in 2022 – GCL-Poly, Daqo and Xinte Energy – are running factories with very low-cost electricity from coal-fired power plants in the Xinjiang Uyghur autonomous region in northwestern China. The area has come under scrutiny after reports surfaced on the widespread use of forced labor there.

“These reports should be a wake-up call for western governments. If their countries don’t want to become almost completely dependent on solar products from China for the transition to renewable energy, they have to implement an effective and long overdue industrial policy for a non-Chinese solar supply chain, in particular for ingot and wafer manufacturing,” commented Bernreuter. “Low-cost and renewable hydropower in the northwestern United States, Canada, Norway and Malaysia offers them the chance to fuel an alternative supply chain without forced labor and a high carbon footprint.”

In December 2020, advocacy group SEIA asked solar companies to sign a pledge against using forced labor in the solar supply chain. The group plans to develop a supply chain traceability protocol for materials used in solar modules to help companies track from where their products are coming.

“Unethical labor practices run against everything we stand for as an industry and are counter to our values,” said Abigail Ross Hopper, president and CEO of SEIA. “It’s on us to be vigilant and take steps to ensure the solar industry is free of forced labor practices. Dozens of companies have already stepped up to sign our pledge and we’re calling on the entire industry to join us.”

The world needs cheap solar power, and China is investing bilions, and billions in securing the whole supply chain. The use only about a third or a quater of what they produce, the rest is exportet to the rest of the world. We only pruduce modules and cells in Europe and USA ingots and wafers is mainly produced in china. China can in 2025 produce around 500GW of solar material. And Europe and the USA will need around 50-100GW of this production ind 2025.

Solarworld (Sunpower) shut down the mono-chrystalline foundry in Hillsboro, Oregon. I visited the plant and was impressed with their quality and technology. Sadly the plant was closed when Sunpower took over losing a vital US source wafer manufacturer as well as many jobs lost.

Thanks for this informative article. When you write “…the vast majority of polysilicon — the absolute foundational building block of solar panels…” do you mean for modules that have multi-crystal cells? It is my understanding that most modules have monocrystalline cells, so would this Chinese dominance of polysilicon apply to them?

Yes. Polysilicon is the foundational building block of silicon-based solar panels, the most popular type of solar panel on the market. Silicon is used in both mono and multicrystalline cells.

Ok, thanks for the quick reply. I find it confusing when they call it polysilicon when it’s used for monocrystalline cells. But, I guess that is the industry name for it. Hopefully, the US will step up and start producing it here again.

Miller, your doubt is genuine. Polysilicon is the basic high quality silicon feedstock for both monocrystalline and multicrystalline (also sometimes mentioned as pycrystalline) solar cell modules. (Remember: Polycrystalline is not the same as polysilicon). Yes, Polysilicon is the basic silicon feedstock.

Monocrystalline silicon solar cells/modules are of higher efficiencies than their multicrystalline counterpart. As the solar industry has fast moved towards higher efficiency modules, high quality, high-purity (11N) silicon is needed, especially in making monocrystalline silicon (PERC) solar cells. It is, therefore, indicative of the fact that multicrystline silicon wafers will be phased out soon. Also note that, many Chinese polysilicon producers, except a few top (four) companies, have failed to produce high-purity polysilicon… Further, China has failed to produce low carbon polysilicon, which US/EU companies are making. What it means? Chinese companies, especially, silicon producers from China, particularly from Xinjiang province, use electricity that is repkete with high CO2 emissions…

So, yes, US and EU companies have greater chance to take lead in supply of high qualty polysilicon.

Thanks for this vital article Ms. Pickerel.

I’d like to know which, if any, companies sell solar panels in the U.S. that use only ethically-sourced component products? If I were to recommend panels for purchase, what panel-makers can i ask my installer to use?

Thank you very much,

David Page

In the U.S. there was REC, that was in its own right a silicon foundry basically powered by hydrogeneration in Washington. Apparently was heavily invested in the Chinese supply chain for silicon wafers. After tariffs roll off, REC is looking to “supply” the industry again.

My hope for the U.S. is thin film solar PV. First Solar has been prosperous in their development and application of CdTe thin film panels. We keep hearing about the efficacy of tandem perovskites (someday) and First Solar has already gone from a product that was once 12% efficient to a product that is 18.3% efficient AND can carry a 25 year (linear) degradation warranty. Perhaps First Solar could also be the first to use tandem or trinary or go the method of the solar cells used in space the multi-junction, often six junctions to harvest 47% of the sunlight in space to power satellites. Pushing the thin film is much more energy efficient than the silicon, to wafer, to dosing into cells, then assembly into panels. First Solar right now seems to be a spray on and fuse operation to make their panels. Just recently IBM created a transistor process that makes 2 nano-meter transistors a decrease from the last record holder of 7 nano-meters. This type of accuracy on an automated solar cell line could be the key to not only multi junction solar cells, but the break through of long lasting solar PV arrays of 30% or more solar harvest efficiency.

1