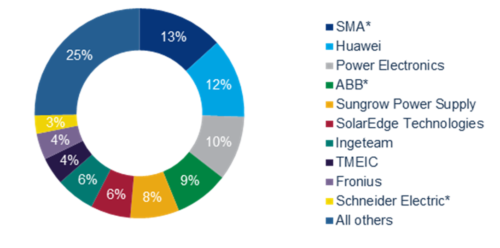

Wood Mackenzie’s newly released report, “The global PV inverter and MLPE landscape 2019,” found the total revenue for the Top 5 global PV inverter vendors underwent a year-over-year decline of 10% last year due to “price pressure and fierce competition.”

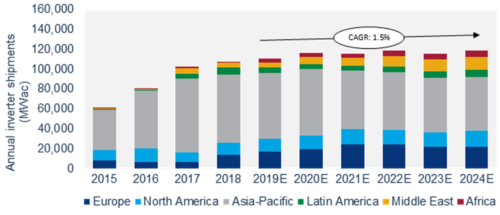

The report found that although global PV inverter shipments will continue to rise, market value will decline through 2024. Price pressure intensified in 2018, in part due to solar policy in China.

More vendors are now centering internet-of-things platforms in their strategy for revenue growth. Others are exiting the inverter industry altogether to focus on more profitable businesses as PV inverter margins grow thinner.

Global annual inverter shipments by region (MWac), 2015 – 2024E

Price pressure worsened with China’s market downturn

Price pressure is fairly constant in the inverter market, but 2018 saw a particular squeeze on vendors.

Late May 2018 brought dramatic policy change in China: a reduced feed-in tariff and end to subsidies for new utility-scale PV power stations. Although China’s policies have since been clarified, the overnight policy shift greatly affected China’s market, and Chinese vendors began expanding more aggressively into international markets as a result, which in turn ratcheted up price pressure in the inverter market.

WoodMac’s numbers paint a clear picture: In 2018, Chinese inverter manufacturers represented 28% of global shipments outside China, up from 22% of shipments in 2017 and 14% in 2016. Chinese companies grew their market shares in Europe, Latin America and the Middle East last year.

Huawei — the top global inverter manufacturer — had perhaps the most success, expanding significantly in Latin America and Europe.

Top 10 inverter vendors by shipments, excluding China’s market (MWac), 2018

*Estimate

As some vendors struggle, others shift to more profitable businesses

The intensification of price pressure has contributed to some manufacturers exiting the inverter space altogether. Most recently, ABB announced it was selling its inverter business to Italian-based vendor, FIMER. The company said it is planning on focusing on more profitable aspects of its electrification business. Read more about the transition and how warranties will be covered moving forward, here.

SMA experienced losses in 2018 which it attributed to immense price pressure as well, reportedly losing over $77 million. The company has recently expanded its inverter service center as another source of revenue.

Other companies are responding to price pressure by building out their internet-of-things platforms or making acquisitions to provide additional services.

A number of PV inverter vendors, in pursuit of differentiation and growth, are expanding their service scope — with a particular focus on launching internet-of-things (IoT) platforms.

Inverters — often described as the brains of a solar system — can connect electronic devices through IOT platforms. Electric vehicles, solar-plus-storage, smart meters, home appliances and other devices can be integrated on one platform. Inverters are uniquely positioned to connect these devices, which is why proprietary IoT platforms are a natural fit for inverter vendors. Read more about hybrid inverters that allow for plug-in-play storage additions here.

Earlier in the year, Schneider exited the utility-scale space to focus on residential, commercial and industrial and IoT business areas, while Seimens purchased KACO’s string inverter business and an inverter storage company to fill out its IoT offering.

Since May 2018, SolarEdge made several acquisitions, looking to become a comprehensive smart energy company, moving beyond the inverter space. The company not only launched a Virtual Power Plant but acquired an uninterruptible power supply company.

SolarEdge also acquired a battery storage company, Kokam, and an e-mobility company, SMRE, to fill out its home energy solutions management service.

What’s next for the inverter market?

The market will likely experience additional consolidation going forward due to price pressure, especially if companies are not successful in expanding or pivoting their scope of services to maintain profitability.

As the market changes, WoodMac forecasts that central standalone inverters and three-phase inverters will have the sharpest drops in revenue of any product type from 2019 through 2024.

Microinverters, single-phase string inverters, DC optimizers and hybrid storage inverters remain much smaller markets in terms of megawatts shipped, but will all experience a growth in market revenue through 2024.

News item from Wood MacKenzie

I find the shake up of the solar inverter industry interesting. ABB like a lot of inverter manufacturers had an advantage with its global VFD manufacturing and distribution networks. Many of the (functions) of a VFD are intrinsic in solar PV inverters. The solar PV inverters do not have to ‘ramp’ and maintain a controlled V/Hz ratio like most motor controls do. A VFD for solar PV applications would cost about half of what a specific solar PV inverter costs per watt. Several drive manufacturers are going towards SiC switching transistors that are more efficient and can tolerate extreme temperatures without adding air conditioning to the electrical cabinet. Simple oversizing of heat sinks can function quite well in high temperature settings without some kind of fan or cooling loop necessary. It is these types of cost cutting methods that the large industrial VFD manufacturers have in their toolbox. What’s the deal?