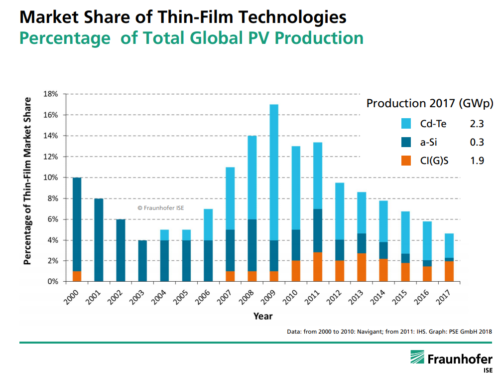

If there’s one product that has the opportunity to benefit from the tariffs on crystalline silicon solar panels, it’s the thin-film module. Crystalline silicon’s (c-Si) slimmer cousin, thin-film is exempt from the 30% solar panel tariff because the U.S. government found that imported c-Si modules—not thin-film—were causing harm to domestic panel manufacturing. That’s no surprise as c-Si holds between 90 and 95% of the global production market share.

Thin-film panel manufacturer First Solar—exempt from the tariffs—is expanding its Vietnam manufacturing plant and will build a new 1.2-GW facility in Ohio to meet utility-scale demand. The expected 500 U.S. jobs will assist with production of the company’s new Series 6 module, which is sized and powered to be competitive with traditional c-Si. Is it finally thin-film’s time to shine?

Since thin-film has found most of its success thus far in either large utility-scale projects or small pocket-sized calculators, it will take a major preference shift and production upgrade for the specialized modules to take off.

Types of thin-film solar

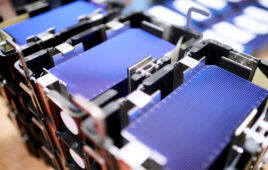

First Solar employees work on Series 4 modules at the company’s Perrysburg, Ohio, manufacturing plant. (Photo by Dennis Schroeder / NREL)

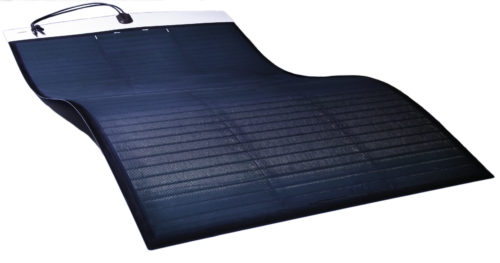

A thin-film solar panel is made of thin films of semiconductors deposited on glass, plastic or metal. The films are incredibly thin, often 20 times thinner than c-Si wafers. This makes thin-film solar panels flexible and lightweight. If the thin-film cells are encased in plastic, the product could be flexible enough to mold to a roof’s shape; when glass is used, thin-film panels are more rigid and heavier.

There are three common thin-film divisions: amorphous silicon (a-Si), cadmium telluride (CdTe), and copper indium gallium selenide (CIGS) or gallium-free CIS.

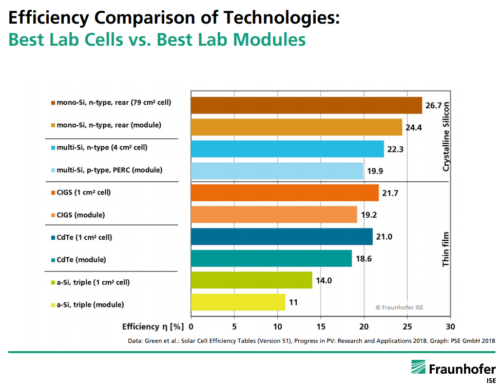

a-Si is the oldest thin-film technology. It uses chemical vapor deposition to place a thin layer of silicon onto the glass, plastic or metal base. It is nontoxic, absorbs a wide range of the light spectrum and performs well in low light but loses efficiency quickly. Pocket and desk calculators use a-Si cells, and PowerFilm produces low-watt, portable solar products using the technology. The highest efficiency on record for a-Si is 13.6%.

CdTe is the most common thin-film solar technology, largely because of First Solar’s utility-scale dominance. In First Solar’s case, cadmium and tellurium (a rare metal) are deposited on glass. In 2016, First Solar hit a CdTe world-record cell efficiency of 22.1%, although its modules average 17%. The Series 6 module should produce 420 W, and its smaller Series 4 modules peaked at about 100 W.

CIS and CIGS modules are usually produced using co-evaporation or co-deposition. Copper, indium, selenide and (sometimes) gallium are deposited onto the substrate at different temperatures to mix together. Solar Frontier has a 22.9% CIS cell efficiency record, while its full modules average lower and peak at 180 W. MiaSolé’s flexible CIGS thin-film modules average 16.5% efficiency and may peak at 250 W.

Comparatively, a typical 60-cell c-Si module averages a power output between 250 and 350 W with an efficiency more near 18 or 19%, with high-efficiency brands performing even better. One would need more thin-film modules and more area to produce the same power as a smaller group of c-Si. Crystalline silicon modules are just more consistently dependable for the majority of solar markets, and that’s why they are the dominant panel choice.

Thin-film market plans

No single thin-film brand appears to be making a grab for c-Si’s market share in the United States. First Solar is expanding its CdTe manufacturing but that’s because it has found that utility-scale sweet spot and is dominating globally. Most CIGS and CIS manufacturers market themselves as niche products.

MiaSolé semi-rigid CIGS modules were initially designed for commercial rooftops, but the company has since branched out into emerging markets like transportation and commercial trucks. When it comes to traditional solar applications, MiaSolé’s best play is its light weight.

“We’ve been going after niche markets. We’re looking for projects that silicon can’t go on. Anything where there can’t be penetration on rooftops, we’d be a good market,” said Peter Park, product manager with MiaSolé. “We don’t really view that we’re going after the same market as silicon. We’re going after what silicon can’t do.”

CIGS manufacturer Sunflare also works with nontraditional solar markets like transportation, marine and modular/tiny home applications. The company has been working to improve the manufacturing process at its plants in Sweden and China to increase thin-film adoption.

“With our new proprietary CIGS manufacturing process, Sunflare has eliminated the issues of the past. Even though CIGS has been around, Sunflare is at the beginning of this technology life cycle,” said Elizabeth Sanderson, Sunflare chief marketing officer. “We expect there to be significant improvements, just as you’ve seen in the lifecycle of silicon. Over time, we expect increases in performance, especially in areas where CIGS has always had an advantage, such as low light capture and better temperature coefficients.”

Sunflare CIGS cells are placed on a stainless steel substrate that is encapsulated between polymer sheets. Each Sunflare cell is manufactured individually, so the company can produce a range of module sizes, although it does make a traditional size for the commercial roofing market equivalent to a 60-cell c-Si module.

“Sunflare performs best on commercial roofs where weight and multiple penetrations are a major issue,” Sanderson said. “Sunflare is 86% lighter than traditional commercial roofing installations. There is no need for racking or heavy ballast. To reduce shading issues, we’ve integrated bypass diodes at every cell. Therefore, shading doesn’t affect our modules like traditional solar.”

Thin-film’s better resistance to shading is its strongest case for the residential market. Solar Frontier has found utility-scale success with its CIS thin-film, but it also heavily markets its anti-glare black modules to the residential space, especially in its home country of Japan. But if a homeowner has a roof clear of obtrusions and shade, c-Si will produce more energy with fewer panels.

The economies-of-scale argument will continue to exist for thin-film as companies try to improve output and efficiency. Park said that MiaSolé is pushing its manufacturing capacity (from plants in California and China) to 1 GW, and that will bring costs down and allow the CIGS modules to become more competitive with c-Si. But for now, the company—along with many of its competitors—is aligning itself with “lifestyle” markets.

“Our new motto is ‘mobile energy now,'” Park said. “When you’re anywhere that’s on-the-go, we provide that energy. As things get more innovative, you’re going to see more solar on cars and different devices. Despite the rollercoaster of solar, many companies have gone away but we’re still a key player in the market. We’re not going away. Thin-film has a place in this world.”

We live in SW Florida where roof cleaning is a necessity. What do we need to be aware of when cleaning our roof when we have solar film? The company that installed the film 10+ years ago is no longer in business. Thank you.

Are the panels glassed or encased in a polymer? This story is more for glassed modules, but it should help: https://www.solarpowerworldonline.com/2020/05/pro-tip-never-use-soap-to-clean-dirty-solar-panels/

Assuming placement on a metal roof, how well do thin film panels adhere in tornado conditions and what is the adhering substance made of?

Also, assuming a metal roof of 3800 square feet to be covered with thin film solar, and assuming Mia Sole’s touted 16.5% efficiency, in order to run a normal house, how much functionality would this house get related to an on grid utility company?

Good Evening

We in South Africa make extensive use of the 175W and 165W thin films, out performing anything else here. My issue is availability?

Cheers Mac